Trump’s New Trade War Tool Might Just Be Antique China Debt

Collectors of pre-Communist debt are lobbying the White House to force Beijing to make good.

By

President Donald Trump’s next move in an increasingly fraught trade war with China could be one for the history books, literally. The Trump administration has been studying the unlikely prospect of reviving century-old claims on Chinese bonds sold before the founding of the communist People’s Republic.

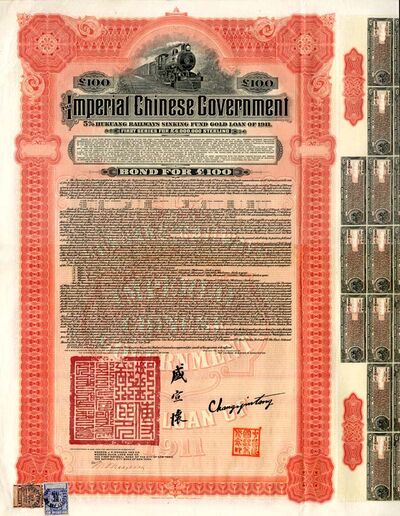

Hundreds,

if not thousands, of these 5% Hukuang Railways Sinking Fund Gold Loan

of 1911 bonds—issued in 1911 by a consortium of banks in London, Berlin,

Paris, and New York—appear to have survived.

The U.S. once referred to the money that flowed into China at the turn of the 20th century as “dollar diplomacy”—a way of building relations with the country (and its massive untapped market) by helping it industrialize. The Chinese have another term for it: For them it fits squarely into China’s “Hundred Years of Humiliation,” when the Middle Kingdom was forced to agree to unfair foreign control.

Soon after the imperial dynasty was overthrown in 1911, the Republic of China began tapping the international capital markets for funding too. That included selling a series of gold-backed notes to fund the nascent country. It’s these bonds that Bianco, who co-founded the American Bondholders Foundation in 2001 to represent holders of pre-communist debt, is hoping could be a useful political leverage in Trump’s fight with China.

“The People’s Republic of China dismisses its defaulted sovereign obligations as pre-1949 Republic of China debt, but doing so contradicts the PRC’s claim that it is sole successor to the ROC’s sovereign rights,” Bianco said in an emailed statement in response to this story.

Bianco says she’s spent years researching the issue and recruiting high-profile proponents to the ABF team, including Bill Bennett, who was U.S. Secretary of Education under Ronald Reagan; Brian Kennedy, senior fellow at the Claremont Institute; and Michael Socarras, Bush’s nominee for Air Force general counsel.

She argues that China is in selective default, having paid out on bonds held by British investors in 1987 as part of the Hong Kong handover deal negotiated by former Prime Minister and ‘Irony Lady’ Margaret Thatcher. If China doesn’t pay out, she says, it should be blocked from selling new debt in international markets. By Bianco’s reckoning, China now owes more than $1 trillion on the defaulted debt, once adjusted for inflation, interest, and other damages—a sum roughly equivalent to China’s holdings of U.S. Treasuries.

“What’s wrong with paying China with their own paper?” says Bianco.

From

left: President Trump, Jonna Bianco, and Brian Kennedy on Aug. 12,

2018, at the Trump National Golf Club in Bedminster, N.J.

Source: Jonna Bianco

People familiar with the Treasury Department say the China bonds have been studied, but ABF’s suggestions—including the possibility of selling the defaulted debt to the U.S. government to then exchange with China—aren’t legally viable. Spokespeople for Treasury and Commerce declined to comment. People familiar with the views of Chinese officials say they’re aware of the meetings, but they don’t think the claims can be revived.

“I think everyone who works for Trump at the Treasury Department thinks this is loony,” says Mitu Gulati, law professor at Duke University and a sovereign-debt restructuring expert. “But I can’t help but be tickled pink, because at a legal level these are perfectly valid debts. However, you’ve got to get a really clever lawyer to activate them.”

Clever lawyers have tried before. The closest anyone got to wringing payment out of China was a class action suit brought by holders of Hukuang railway bonds in 1979 that managed to bring the PRC to court to defend itself for the first time. Gene Theroux, formerly senior counsel at Baker & McKenzie LLP, helped represent the Chinese government in court.

Theroux, now retired, remembers the landmark case well. “The requests of us as lawyers were occasionally unusual,” he says, including China nixing any citation of previous cases with “Republic of China” in the title, given its refusal to recognize the regime under its “One China” policy. (Eventually, Baker & McKenzie resolved the problem by citing old cases as “Republic of China [so-called].”)

The suit was thrown out on the basis that the 1976 Foreign Sovereign Immunities Act, which allows U.S. courts to hear cases against foreign governments for commercial claims, could not be retroactively applied to bonds issued at the turn of the century.

Since then, a 2004 Supreme Court decision ruled that the FSIA could apply retroactively in a case immortalized in the movie Woman in Gold. The ruling paved the way for Maria Altmann to reclaim paintings by the famous Austrian artist Gustav Klimt decades after they’d been seized by the Nazis.

That still leaves the problem of reactivating modern legal claims on debt that is now decades old. Gulati argues that this could perhaps be done—for instance, by arguing that China making payments on modern bonds violates pari passi (equal payment) clauses embedded in the historic debt. Such clauses were successfully used by hedge funds seeking payment from Argentina a few years ago. It’s a legal long shot, but one that Gulati has assigned to his law students as a theoretical exercise.

The U.S. Securities and Exchange Commission is studying the debt, too. In a 2018 complaint against Pastor Caldwell and a self-described financial planner named Gregory Alan Smith, the SEC accused the pair of raising at least $3.4 million by persuading 29 investors to buy the pre-revolutionary bonds. Some of the buyers, mostly elderly retirees, liquidated their annuities to invest, the SEC said.

Messages left for Caldwell’s lawyer, Dan Cogdell, weren’t returned. In a press conference in March, Cogdell said the charges against his client were “false.” Caldwell, who was educated at Wharton before working as a bond salesman at First Boston and going on to officiate at Jenna Bush’s wedding, said the bonds are “legitimate” and has returned money to investors at their request. Smith entered a plea agreement to the charges last month.

“Defendants falsely represented to these investors that the bonds were safe, risk-free, worth tens, if not hundreds, of millions of dollars, and could be sold to third parties,” the SEC said in its complaint. “In reality, the bonds were mere collectible memorabilia with no investment value.”

—With Saleha Mosin, Jennifer Jacobs, and Steven Yang.

(Updates

with a U.K. bondholders agreement from 1987 in 11th paragraph .

Clarifies that ABF represents ROC bondholders in eighth paragraph,

includes response from ABF in ninth paragraph.)

湖廣債券成特朗普貿戰「新武器」

彭博:美擬追華8萬億清朝債

有傳美國政府要求北京償還清朝國債,被視為美方貿戰談判的新武器。設計圖片

【中美貿易戰】

中美貿易戰持續延燒之時,有美媒披露白宮或出新招,要求中國政府償還百多年前清朝留下的國債,此被視為美方對華貿易戰「新武器」之一。報道指這批債券是清朝末年為修建湖廣鐵路,向美國、英國等國借錢而發,目前估值約1萬億美元(下同,約7.84萬億港元)正好是中國持有美國債務的數額;債券持有者要求白宮將其納入對華貿易戰工具之一;總統特朗普近期曾接見過債權人代表。中方未對有關報道作回應。

《彭博商業周刊》(Bloomberg Businessweek)報道,特朗普政府欲要求中國政府償還清朝留下的1萬億美元債券,這被視為美方在貿易戰的新武器。這些債券是清政府1911年為修建湖廣鐵路向英國、美國、法國、德國等國家銀行借錢而發的「國債」,利息5厘,為期40年,至1951年為止;即「湖廣鐵路五厘利息遞還金英鎊借款債券」(簡稱湖廣債券)。不料錢剛借到就爆發辛亥革命,1912年大清王朝被推翻,成為歷史。

相關新聞:不還惡債恐難收回撒幣

發行一年清朝被推翻

1912年民國成立初,北洋軍政府不承認這些債務,但後來民國政府曾一度為湖廣債務付利息,直到1938年為止。1949年中共建政後拒承認這些債務,但數十年來,美國債權人一直追討。1979年中美建交不久,美方有債權人在美國入稟法院向中國政府索償;法院在中方缺席下判中國政府向原告賠四千多萬美元;中國政府經外交交涉及緊急應訴等,加上美國政府支持(其時美中關係正開始蜜月)下扳回敗局,贏得官司。

據報道,隨着中美貿易戰深入,特朗普對華言論越來越強,湖廣鐵路債券美國持有者對華索債意念再起。特朗普和財長姆欽、商務部長羅斯前不久曾會見債券持有人及代表。這批百多年前的中國債券可在不少美國家庭的閣樓和地下室找到,也有人在網上出售。《蘋果》記者在內地一些美術品拍賣平台查到,1911年版湖廣鐵路債券,20英鎊及100英鎊面值,拍賣價從500至2,000人民幣(約550至2,200港元)不等。

學者︰索償完全合法

美國債券持有人基金會(American Bondholders Foundation,ABF)共同創辦人畢昂可(Jonna Bianco)表示,中國將這些債務視為1949年前中華民國所有,拒絕償還,這與北京聲稱自己是中國唯一繼承者說法矛盾。美國杜克大學法學教授古拉提(Mitu Gulati)表示,在法律層面上,這些債務持有人向中國政府索償,是完全合法的。

美國輿論曾把20世紀流入中國的錢稱為「美元外交」。但過去一百年中國數度改朝換代,後來者多視前朝與外國簽訂的協議為「不公平」、「喪權辱國」而拒絕繼承。1912年清朝被推翻後,中華民國也開始利用國際資本市場獲得資金。有鑑於此,畢昂可等人於2001年創立美國債券持有人基金會,他們希望成為特朗普與中國鬥爭的有用的政治槓桿。

《彭博商業周刊》

No comments:

Post a Comment